As the case for European equities gains wider recognition, portfolio manager Marcel Stotzel explores what he believes is a compelling opportunity to invest in world-class quality companies listed in the region, underpinned by structural improvements and attractive valuations. Here, he examines why a focus on quality companies with strong defensive characteristics can help navigate an uncertain market environment and position investors for long-term outperformance.

Recent policy announcements from the US have served as a wake-up call for Europe, sparking a need for greater continental unity and policy coordination. This is most evident in defence spending, but it is also clear that the region needs to improve productivity.

Germany’s new parliament has approved plans to reform the country’s constitutional debt brake, thus removing constraints on defence spending and paving the way for the creation of a €500bn infrastructure investment fund. This would equate to 11.6% of Germany’s 2024 GDP, to be spent in the coming 10 years. The proposed constitutional reform to exclude defence spending of more than 1% of GDP from the debt brake will enable an open-ended rise in expenditure over the existing off-budget defence fund, which was previously limited to €100bn between 2022 and 2027.

Germany’s spending should be coupled with sizable fiscal expansion at the EU level. The European Council has also approved a proposal to exempt defence spending from the EU’s fiscal rules and to set up a €150bn EU loan facility to fund military expenditure.

This stimulation of the European economy has been very positively received, particularly as US tariff uncertainty threatens to impact the region’s exports of goods. While the impact from tariffs will still be felt and we await the full details, it is encouraging that Europe is putting some self-help measures in place. If these policies are supplemented by the implementation of the recommendations outlined in the Draghi report on cutting red tape and bureaucracy, it could bring a further boost as the region addresses structural inefficiencies that have long hindered competitiveness.

These developments suggest progress toward greater European integration, moving beyond monetary union and freedom of movement toward more comprehensive policy coordination. While this still may be the holy grail, any shift in the right direction from a low starting base could unlock significant economic benefits, particularly if European investors mobilise record-high savings rates currently parked in low-yielding cash and real estate investments.

Markets have already begun to recognise this potential, particularly as investor sentiment shifts away from US exceptionalism. Concerns about US growth and policy uncertainty are driving unprecedented capital flows towards European markets which have demonstrated notable resilience in 2025, outperforming global counterparts.

Identifying quality opportunities

While these policy changes create a supportive environment, it’s worth noting that European companies are not proxies for Europe’s economy. Two-thirds of benchmark revenues from European companies originate outside the region, with the rest of the world eager buyers of European goods and services that in many cases are best in class and compete successfully on the global stage. Longer-term equity returns are primarily driven by real dividend and earnings growth, not regional economic growth.

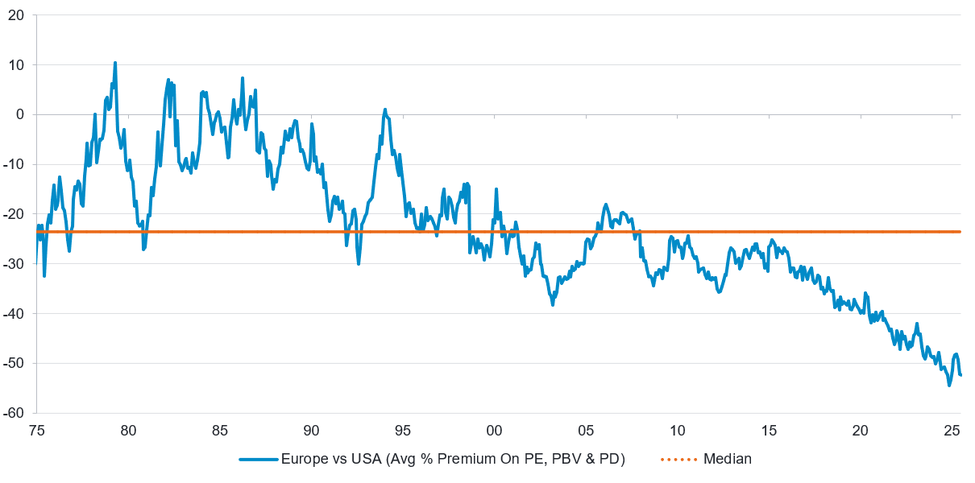

Moreover, the fluctuations in regional market leadership make a case for reducing exposure to expensive markets and allocating to more attractively valued regions, particularly given Europe’s 30-year valuation discount versus your US counterparts. Even after the recent rally, European markets continue to trade at significant discount to US counterparts. The combination of attractive valuations and improving fundamentals creates favourable risk-adjusted return potential for quality-focused investors.

European valuations are relatively attractive

Long term outperformance of US vs. Europe…

Source: MSCI, LSEG DataStream, Morgan Stanley, Fidelity International, 29 May 2025.

…has left European valuations looking compelling

Source: MSCI, IBES, Morgan Stanley Research, 4 July 2025. Note: Average relative valuations use 12M forward data where available (forward P/E data starts in 1987) and trailing data where forward P/E not available.

Identifying the most compelling opportunities in this environment requires focusing on companies with specific quality characteristics. Quality businesses are characterised by several key attributes, including stable or growing end markets without excessive sensitivity to external variables such as the macro environment. They also tend to have clear business models, strong competitive positions and a sensible balance sheet structure with conservative use of debt providing the flexibility to fund sustainable dividend growth.

Dividend growth can be the key to long-term success

Finding durable business models and the management teams who share our point of view on capital allocation become the two principal determinants of success in the long-term. Of these characteristics, dividend growth stands out as particularly crucial as companies that consistently grow their dividends significantly outperform those that cut or merely maintain distributions, reflecting underlying business health and management discipline. Companies that consistently grow their dividends represent healthy businesses with stable earnings growth and strong free cash flows, characteristics consistently rewarded by markets over time. This dividend growth focus serves as both an income generator and a quality screen, while maintaining defensive characteristics during market downturns.

3i Group is an example of a company that demonstrates the kind of quality characteristics we seek. 3i’s largest asset is discount retailer, Action. Action has very high returns on capital and is a rare business in that it gets stronger as it gets bigger as it consistently passes on to customers the benefits of its huge purchasing power in the form of lower prices. To demonstrate the scale of the operation, astonishingly, Action shifted more of a particular battery last year than Wal-Mart! The company is at c.2,700 stores in Europe now and they estimate that they can get to 5,000. The CEO is well-aligned with minority shareholders with a very large personal shareholding.

Amadeus, a Spanish booking platform and IT solutions company for the hotel and airline industries, is another example of a company with quality characteristics and strong upside potential. The company has made substantial investments to widen its lead over competitors, achieving its strongest competitive position in years across all divisions. The stock is well placed to benefit from this reinvestment cycle over the next five years, with expectations of expanding margins and robust free cash flow growth.

Another example is Finnish lift manufacturer Kone. While the company has some exposure to cyclical areas such as original equipment and construction, the majority of profits is derived from maintenance of the existing installed lift base. This maintenance business is regulated, providing greater stability and visibility of returns over time across different macroeconomic scenarios.

Our strategies exemplify proven frameworks for navigating market uncertainty through rigourous capital preservation and systematic stock selection. These strategies share common philosophies that prioritise bottom-up company analysis over macro-economic positioning, recognising that sustainable business fundamentals drive long-term outperformance. This disciplined, fundamentals-driven approach positions investors well for the opportunities that lie ahead.

A compelling opportunity

We believe Europe presents a compelling opportunity for quality-focused investors willing to take a long-term view. The combination of structural policy improvements, attractive valuations relative to other regions and access to world-class companies with global revenue exposure creates a favourable investment environment.

The external pressures facing Europe have catalysed positive changes that could drive GDP growth and close the productivity gap with the US over the next five to 10 years. While tariffs and recession risks could temporarily disrupt this trajectory, the underlying structural improvements appear sustainable.

The Fidelity European Trust offer access to European quality companies, with the Trust offering broader quality exposure with tactical flexibility through gearing.

For investors seeking quality European exposure, the current environment presents an attractive entry point. The combination of defensive positioning, quality focus and attractive valuations creates asymmetric risk-reward profiles suitable for navigating uncertain macro conditions, while positioning for long-term outperformance as European structural improvements materialise.

Important information

The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Overseas investments are subject to currency fluctuations. The Fidelity European Trust PLC uses financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Investors should note that the views expressed may no longer be current and may have already been acted upon.

News & Insights - European Values PLC

Why Europe still offers attractive opportunities in 2026

Fidelity European Trust portfolio managers Sam Morse and Marcel Stötzel expla…

The case for an improving outlook in Europe

Marcel Stötzel, Co-Portfolio Manager of the Fidelity European Trust PLC, shar…

Why we remain positive about Europe’s outlook

Marcel Stotzel outlines why quality businesses backed by strong balance sheet…